Aussie strengthens on fresh risk appetite but key barrier still resists

Risk-sensitive Aussie dollar continues to benefit from improved sentiment that lifted stocks and deflated dollar.

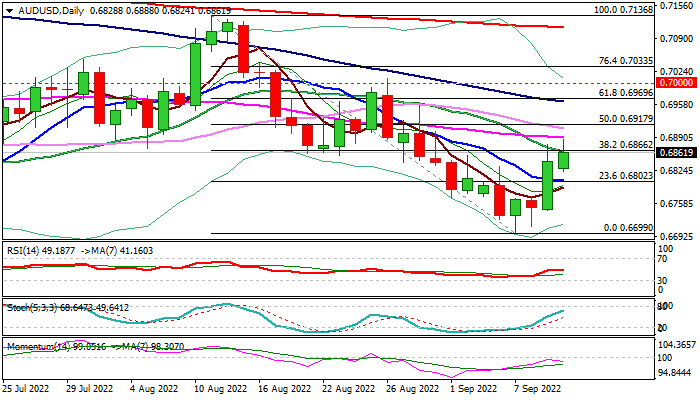

Fresh advance in early Monday extends last Friday’s 1.2% rally (the biggest daily gain since Aug 10) and probe again through pivotal barrier at 0.6866 (Fibo 38.2% of 0.7136/0.6899 / 20DMA).

Sustained break here will generate fresh positive signal in addition to Friday’s bullish engulfing pattern that would open way for further correction through 55DMA (0.6891) and test of next key levels at 0.6911/17 (daily cloud base / daily Kijun-sen).

Despite improved conditions, caution is still required as bearish momentum is strengthening again on daily chart after recent ascend failed to break into positive territory that warns of possible recovery stall, initial signal of which could be expected on repeated failure to close above 0.6866 pivot.

Near-term bias is expected to remain with bulls as long as action stays above broken 10DMA (0.6804) though the downside would remain vulnerable while 0.6866 barrier resists attacks.

Res: 0.6866; 0.6891; 0.6917; 0.6956

Sup: 0.6824; 0.6804; 0.6791; 0.6744