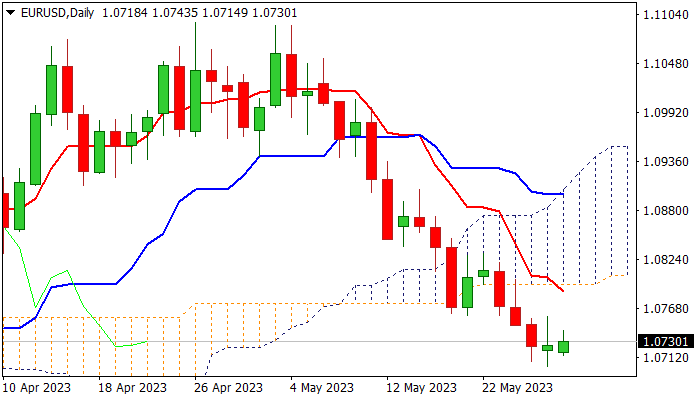

Larger bears to remain intact while key 1.0800 resistance zone caps recovery

The Euro edges higher in early Monday trading, generating initial bullish signal on formation of reversal pattern on daily chart, after Friday’s Doji candle signaled indecision.

Oversold daily studies and weaker dollar on growing optimism about US debt ceiling deal, contribute to euro’s fresh strength.

Stochastic is emerging from oversold territory on daily chart and 14-d momentum turned up (still deeply in the negative zone) sending initial positive signals.

Today’s close above Friday’s high (1.0758) is seen as a minimum requirement in formation of reversal pattern, which will keep renewed bulls in play for attack at key barriers at 1.0800 zone (falling daily Tenkan-sen / Fibo 23.6% of 1.1095/1.0701 / base of thickening daily cloud).

Sustained break here is needed to generate stronger bullish signal and open way for recovery towards 1.0852 (Fibo 38.2%) and 1.0898 (daily Kijun-sen / 50% retracement of 1.1095/1.0701).

Conversely, failure to clear pivotal 1.0800 zone would keep larger bearish structure intact and offer better selling opportunities.

Res: 1.0758; 1.0800; 1.0831; 1.0852

Sup: 1.0700; 1.0652; 1.0631; 1.0600