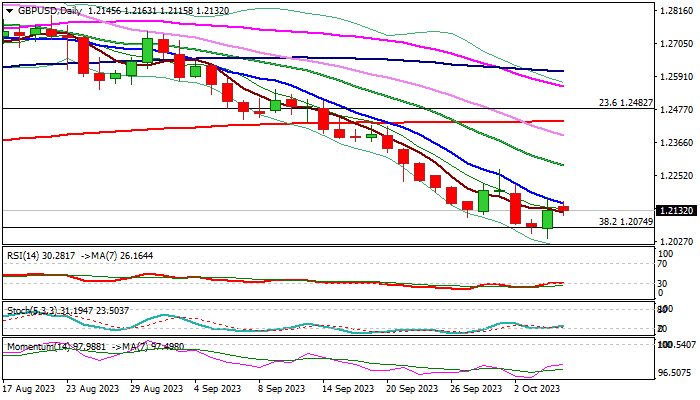

GBPUSD – falling 10DMA continues to cap recovery attempts

Cable started to lose traction in early European trading on Thursday, after Wednesday’s recovery, supported by better than expected UK services PMI and US ADP miss, stalled under initial resistance – falling 10DMA (1.2173), which continued to cap the action.

UK construction PMI (released this morning) dipped well below expectations in September and slid below 50 threshold for the first time since March 2020, adding to fresh negative signals.

Technical picture on daily chart remains firmly bearish with strong downside risk while 10DMA continues to limit recovery attempts.

Larger bears faced a double rejection at pivotal Fibo support (38.2% of 1.0348/1.3141) at 1.2074, but mild correction (capped by 10DMA) keeps the downside vulnerable, with eventual break here to expose psychological 1.20 support and daily cloud top at 1.1988.

Meanwhile, the pair may hold in extended consolidation within 1.2074/1.2173 range before bears resume.

Conversely, sustained break above 10DMA would ease downside pressure, but stronger reversal signals expected on lift above falling 20DMA (1.2286).

Res: 1.2173; 1.2217; 1.2286; 1.2328

Sup: 1.2115; 1.2074; 1.2037; 1.2000