GBPUSD – risk appetite lifts the pair to seven-week high

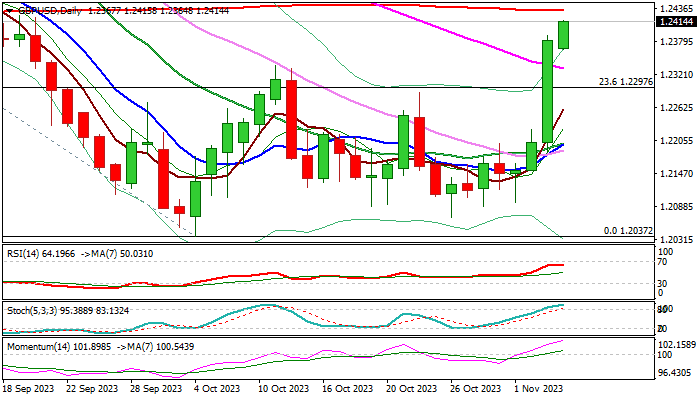

GBPUSD bulls held grip at the start of the week and cracked psychological 1.2400 barrier, in attempts to extend Friday’s nearly 1.5% advance.

Fresh risk appetite gave strong boost to sterling, in addition to BOE’s hawkish stance despite keeping rates on hold last week and warning signals from various sectors of the US economy and dovish steer from the central bank in response.

Last week’s advance and close above the ceiling of a multi-week consolidation range generated a signal of formation of a higher base (1.2040/70 zone) and possible stronger recovery.

Bulls eye pivotal barriers at 1.2434/58 (200DMA / Fibo 38.2% of 1.3140/1.2037 downtrend) violation of which to generate stronger reversal signal and open way for extension towards daily cloud top (1.2516) and 100DMA (1.2541).

Bullish daily studies contribute to positive near-term outlook, though overbought conditions warn.

Bullish bias to remain intact while dips stay above broken daily cloud base (1.2347).

Res: 1.2434; 1.2458; 1.2541; 1.2588

Sup: 1.2347; 1.2337; 1.2297; 1.2242