Dollar index is consolidating above one-month low; prospects for further losses

The dollar index remains in defensive on Friday and consolidating under new one-month low (103.74) posted after Thursday’s 0.8% drop.

The greenback was deflated by weaker than expected US CPI data in June which fueled bets for Fed rate cut in September.

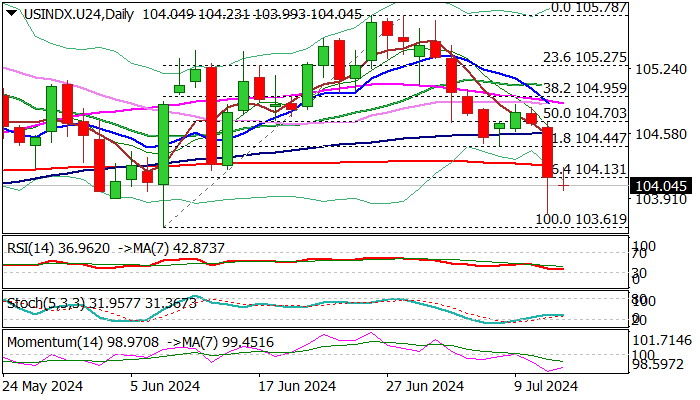

Technical picture remains bearish, with Thursday’s close below 200DMA (104.23, which reverted to solid resistance and caps upticks for now) generating fresh bearish signal.

The dollar index is on track for the second consecutive weekly loss, with weekly close below cracked Fibo support at 103.61 (76.4% of 103.61/105.78) to reinforce bearish stance and open way test of key short-term support at 103.61 (June 7 low) loss of which to complete failure swing pattern on daily chart and risk deeper fall.

Extended upticks should be capped by daily Ichimoku cloud top (104.49).

Res: 104.23; 104.44; 104.49; 104.70

Sup: 103.74; 103.61; 103.33; 103.00