AUDUSD holds in extended sideways mode, awaiting key economic releases for direction signals

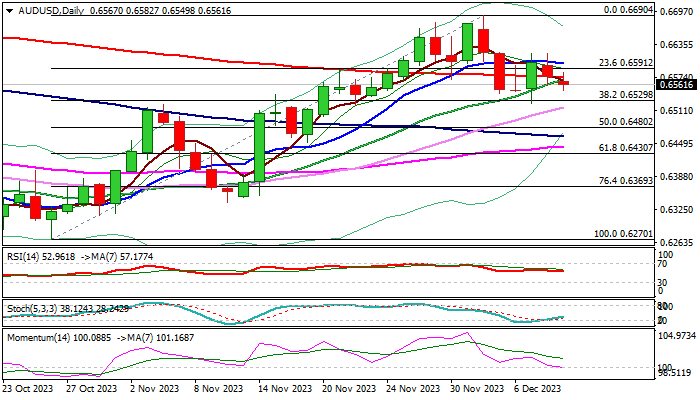

AUDUSD eases further on Monday and breaks below 200DMA which marks approximately the mid-point of 0.6525/0.6620 congestion, in which the pair is holding for the fifth straight day.

Near-term action lacks clear direction signal while holding within the range, as daily MA’s are in mixed setup and momentum indicator is moving along with the centreline, although, the larger picture is still bullishly aligned.

Range floor also marks significant Fibo support (38.2% retracement of 0.6270/0.6690) and near-term bullish bias is expected to remain in play while the price action stays above this level, however lift and close above range top is required to verify bullish signal and shift focus higher.

Conversely, firm break of 0.6525 pivot would risk deeper pullback.

Investors await release of Australia’s business confidence and US inflation report on Tuesday, as well as Fed’s rate decision on Wednesday.

Res: 0.6574; 0.6601; 0.6619; 0.6656

Sup: 0.6550; 0.6525; 0.6480; 0.6430