Bears are set to extend as studies and fundamentals maintain negative sentiment

The Euro remains in red on Thursday and probes below Wednesday’s low (1.0781), posted after thee-day 1.6% fall.

Bears gained pace after bull-trap was formed last week, with decision of German top court and strong dollar, keeping the pair under pressure.

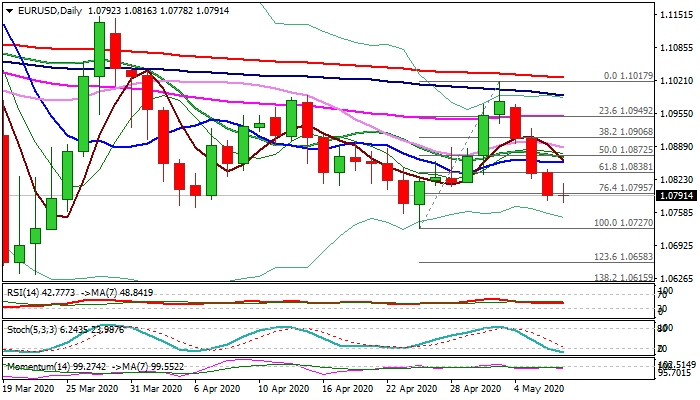

Bearish daily studies and Wednesday’s close below Fibo 76.4% of 1.0727/1.1017, adding to negative signals.

Pivotal support at 1.0727 (24 Apr low) is coming in focus, with break here to signal an end of month-long range and unmask key short-term support at 1.0635 (2020 low posted on 23 Mar).

Broken Fibo level at 1.0838 (61.8% of 1.0727/1.1017) and 10DMA (1.0859) mark solid barriers which are expected to cap corrective upticks and keep bears in play.

Res: 1.0816; 1.0838; 1.0859; 1.0867

Sup: 1.0778; 1.0768; 1.0727; 1.0700