Bears eye key support at 109.71 after cracking psychological 110 level

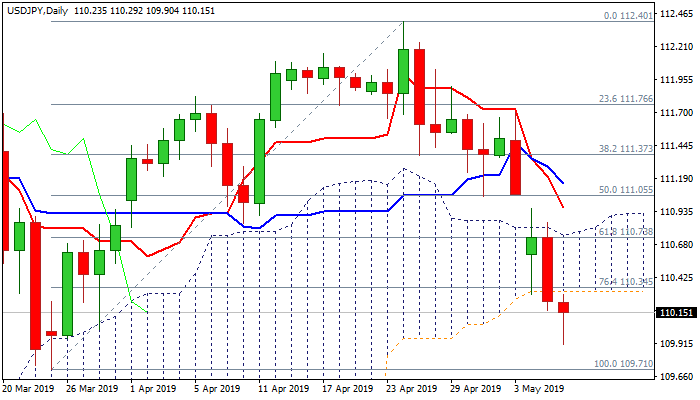

The pair consolidates above new six-week low at 109.90, posted in extension of strong fall on Tuesday (0.45%), but remains firmly in red, following strong bearish signal, generated on Tuesday’s close below important supports at 110.34/31 (Fibo 76.4% of 109.71/112.40 / daily cloud base).

Today’s probe below psychological 110 support adds to bearish bias, as yen remains supported by safe-haven buying.

Bears eye key short-term supports at 109.71 (25 Mar trough) and 109.58 (weekly cloud base), with break here expected to trigger further weakness.

Oversold daily studies warn of consolidative/corrective action preceding fresh downside, with extended upticks through daily cloud base (110.31) expected to stall under cloud top (110.78) and provide better positions for re-entering bearish market.

Only return and close above daily cloud would delay bears.

Res: 110.31; 110.61; 110.78; 110.95

Sup: 109.90; 109.71; 109.58; 109.41