Bears regain control and probe through key supports again ahead of Fed

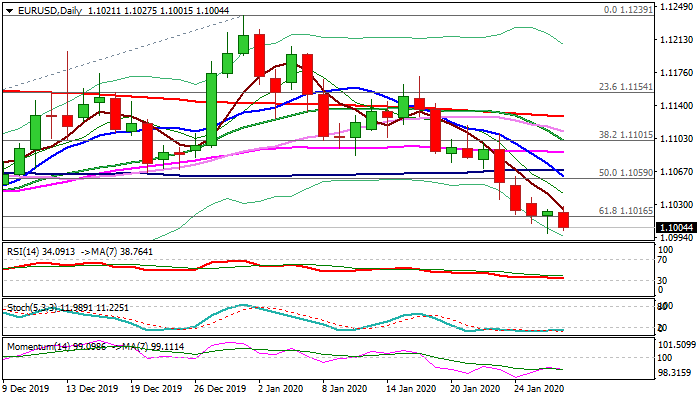

The Euro was sold in early European session trading on Wednesday and probed again below important Fibo support at 1.1016 (61.8% of 1.0878/1.1239 ascend) following double failure to close below and generate strong bearish signal.

Fresh weakness cracks again psychological 1.10 support and eyes another key level at 1.0981(29 Nov trough), break of which would open way towards 2019 low at 1.0878 (1 Oct).

Bearish daily studies support scenario with focus on today’s Fed decision at the end of two-day policy meeting.

The US central bank is widely expected to keep rates unchanged in its first meeting this year (following three cuts in 2019) and markets will be carefully listening the comments from the central bank.

The US economy is stable but the future is uncertain on rising fears over coronavirus spreading and the intensity of negative impact on global economy.

Current risk-off mode is likely to extend if the situation deteriorates further that would further boost dollar’s safe-haven appeal and keep the single currency under pressure.

Initial resistance lays at 1.1025/27 (Tue/today highs) followed by falling daily Tenkan-sen (1.1070) and rising daily cloud base (1.1090) which needs to cap stronger upticks and keep bears in play.

Res: 1.1027; 1.1061; 1.1070; 1.1090

Sup: 1.1000; 1.0981; 1.0963; 1.0878