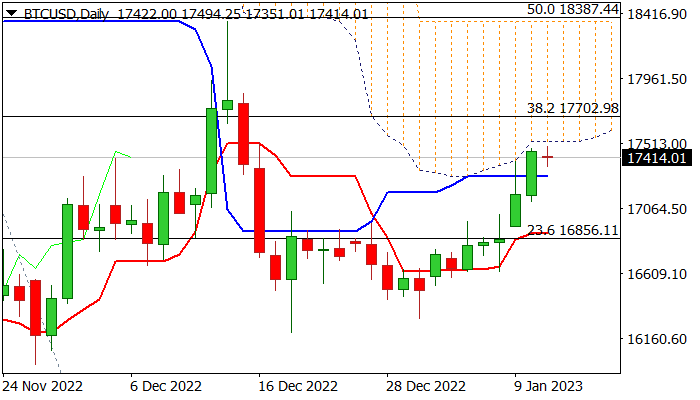

Bitcoin keeps bullish bias but daily cloud limits the action for now

Bitcoin is trading in a quiet mode on Wednesday, after rally in past two days faced headwinds from the base of thick daily cloud (1752), reinforced by Fibo 61.8% of 1863/1620 bear-leg.

Overbought conditions on daily chart also contribute to current conditions, although near-term bias remains with bulls, as positive momentum is still strong and DMA’s (10/20/30) are in bullish configuration.

Bullish scenario requires firm penetration into daily cloud which would bring in focus next key barrier at 1836 (cloud top / Dec 14 high / 50% retracement of 2128/1548 fall) and signal bullish continuation of recovery from 2022 low (1548).

Repeated failure under daily cloud would increase downside risk, but near-term structure should keep positive stance above rising 10DMA (1689) which today formed a bullish cross with 20DMA).

Res: 1752; 1770; 1810; 1838

Sup: 1714; 1689; 1630; 1620