Slight bullish bias seen ahead of key US inflation report

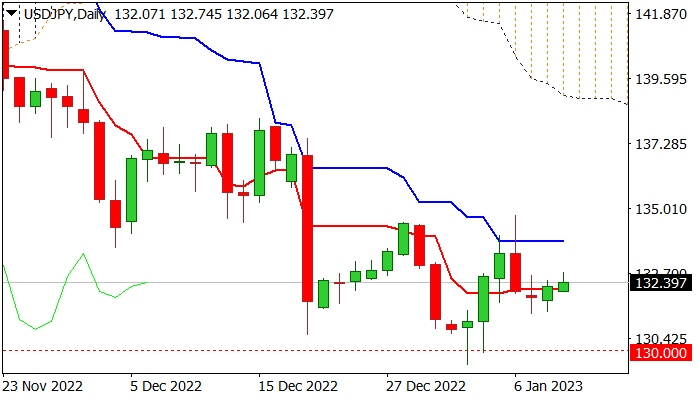

The USDJPY remains constructive and edges higher on Wednesday, following weak Japanese data overnight and a bear trap under Fibo support at 131.51 (61.8% of 129.50/134.77).

Wednesday’s action, however, is rather quiet, as markets await stronger signals from US inflation data, due on Thursday, with flat momentum on daily chart, contributing to current mode.

Fresh bulls need to register repeated close above daily Tenkan-sen (132.13) to keep a minor bullish bias, with lift above daily Kijun-sen (133.84) to tighten grip and open way for stronger recovery.

Close below Tenkan-sen, on the other hand would keep the downside at risk for renewed probe through psychological 130 support and test of January low at 129.50.

US inflation data are likely to be a catalyst for stronger acceleration, with Dec values to define direction.

Res: 132.74; 133.84; 134.50; 134.77

Sup: 132.13; 131.55; 130.56; 130.00