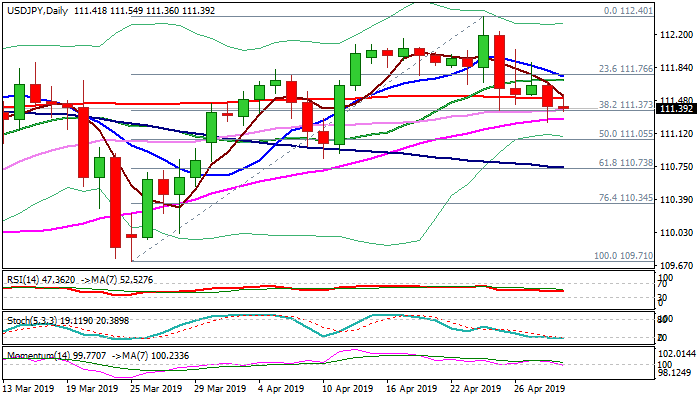

Break of 200SMA needs confirmation on close below 30 SMA; Fed eyed for fresh signals

The USDJPY pair holds in narrow consolidation between key points at 111.50 (200SMA) and 111.37 (Fibo 38.2% of 109.71/112.40, reinforced by 30SMA) in Europe on Wednesday.

Tuesday’s eventual close below 200SMA was strong negative signal for broader dollar bulls, which requires confirmation on break and close below 111.37 Fibo support and signal reversal.

Fresh bearish momentum adds to negative outlook, as 10/20SMA in bearish setup converge and on track to form bear-cross, while thinning daily cloud (cloud top lays at 110.86) would be also magnetic.

Sustained break below 111.37 would open immediate support at 111.27 (55SMA) and risk extension towards 111.05 (50% retracement and 110.86 (daily cloud top).

Conversely, return and close above 200SMA would have negative impact on fresh bears from 112.40 (24 Apr high).

The pair is likely to hold in neutral near-term mode and await for fresh signals from US data / Fed, due later today.

Res: 111.50; 111.70; 111.90; 112.03

Sup: 111.37; 111.27; 111.05; 110.86