Bulls are losing traction on approach to key resistance

The Australian dollar remains well supported, with strong gains against Japanese yen, underpinning the AUDUSD pair.

Aussie advanced around 5% vs the US dollar and 10% vs yen in past almost two weeks, as Japanese currency remains under pressure on dovish BoJ and soaring prices of commodities and energy, as the country heavily depends on imports.

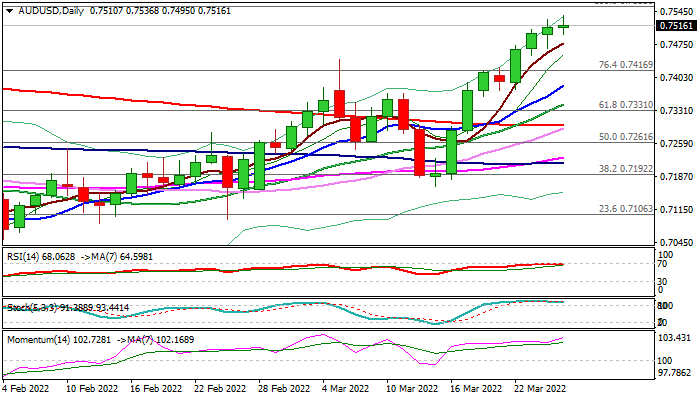

The daily chart shows that AUDUSD price action is slowly running out of steam, on approach to key resistance at 0.7555 (28 Oct 2021 high) as the bodies of daily candles are getting smaller, while shadows are longer on both sides.

Although the bullish momentum continues to strengthen, overbought stochastic adds to signals of stall.

Correction is likely to be shallow, as weekly studies are in full bullish configuration and the pair is on track for the second strong weekly gains and close above weekly cloud top that generates bullish signal.

Good supports lay at 0.7441/17 (Mar 7 spike high / broken Fibo 76.4% of 0.7555/0.6967) with extension towards rising 10DMA (0.7385) not ruled out and expected to offer better levels to re-enter bullish market.

Break of 0.7555 pivot would expose net key barrier at 0.7634 (Fibo 38.2% of 1.1079/0.5514, 2011/2020 downtrend).

Res: 0.7536; 0.7555; 0.7600; 0.7634

Sup: 0.7477; 0.7441; 0.7417; 0.7385