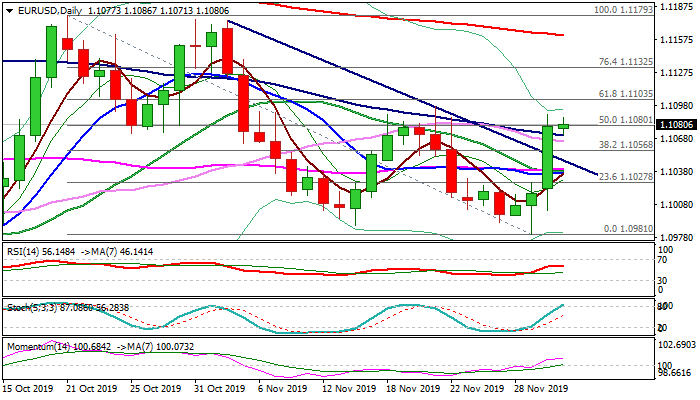

Bulls consolidate under pivotal barriers; daily cloud underpins the action

The Euro maintains firm tone and holding above thick daily cloud on Tuesday, following 0.51% rally on Monday (the biggest one-day advance since 17 Sep) after downbeat US manufacturing data deflated dollar.

Bulls approach pivotal barrier at 1.1096 / 1.1103 (21 Nov high / Fibo 61.8% of 1.1179/1.0981) after Monday’s surge through thickening daily cloud, with break here to generate strong bullish signal for extension of rally from 1.0981 spike low, where bears were trapped at important Fibo support.

The pair maintains strong bullish momentum, but overbought stochastic and sideways-moving RSI suggest consolidation before bulls resume.

Broken cloud top (1.1065) should ideally keep the downside protected, to keep bulls intact for break through 1.1096/1.1103 pivots and extension towards falling 200DMA (1.1161).

Below cloud top, solid supports lay at 1.1056 (broken Fibo 38.2%) and 1.1040 zone (converged daily 55/20/10DMA’s) loss of which will be bearish signal.

Res: 1.1089; 1.1096; 1.1103; 1.1161

Sup: 1.1071; 1.1065; 1.1056; 1.1040