Bulls continue to face strong headwinds at 200DMA

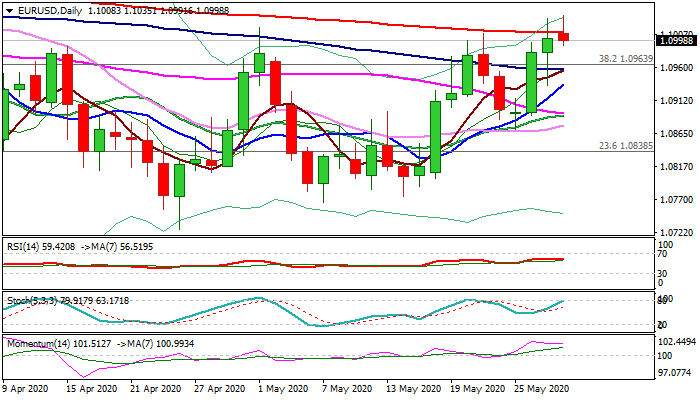

The Euro is holding within 1.10 zone in European session on Thursday after hitting new, marginally higher high (1.1035) in nearly two months.

Bulls failed to close above 200DMA (1.1009) on Wednesday, despite spike to 1.1030, signaling that fresh advance faces strong headwinds in attempts to eventually break out of larger range-trading.

Technical studies on daily chart are bullish and support scenario, however, stochastic is approaching the border of overbought zone and warning that bulls may stay congested between 100 and 200DMA’s (1.0956/1.1009 respectively) before final push higher.

Break of 200DMA would open next key obstacle at 1.1065 (daily cloud top / 50% of 1.1494/1.0635) break of which would generate strong bullish signal and expose targets at 1.1147/66 (27 Mar high / Fibo 61.8%).

On the other side, loss of 100DMA support would generate initial negative signal, with extension below 10DMA (1.0935) to warn of recovery stall.

Res: 1.1009; 1.1035; 1.1065; 1.1100

Sup: 1.0991; 1.0956; 1.0935; 1.0893