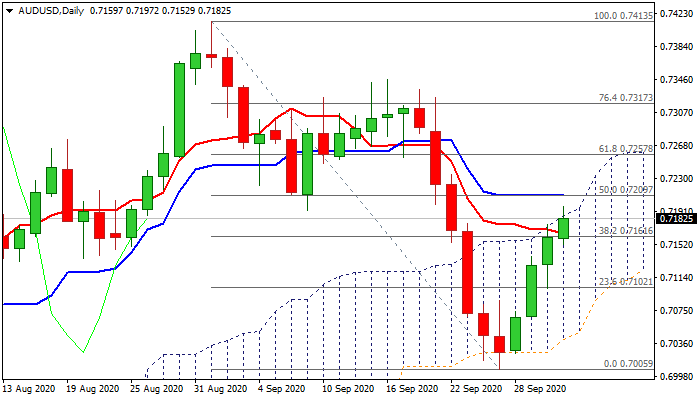

Bulls need close above cloud top / 20DMA to neutralize existing risk of stall

The Australian dollar extends rally into fourth straight day, advancing 2.1% since the base of thick daily cloud contained last week’s steep fall.

Fresh risk mode and rally in China’s yuan additionally boosted Aussie, as bulls broke above pivotal Fibo barrier at 0.7161 (38.2% of 0.7413/0.7005) and probed above daily cloud top (0.7186) today.

Bulls need to clear daily cloud top and nearby 20DMA (0.7208) to generate signal for continuation, but daily studies warn of stall as momentum turns sideways (still in negative territory) and stochastic entered overbought territory.

Near-term action would remain biased higher above broken Fibo barrier at 0.7161, while return and close below 10DMA (0.7136) would sideline bulls.

Res: 0.7193; 0.7208; 0.7229; 0.7257

Sup: 0.7161; 0.7152; 0.7136; 0.7100