Bulls pressure falling weekly cloud as positive fundamentals continue to underpin

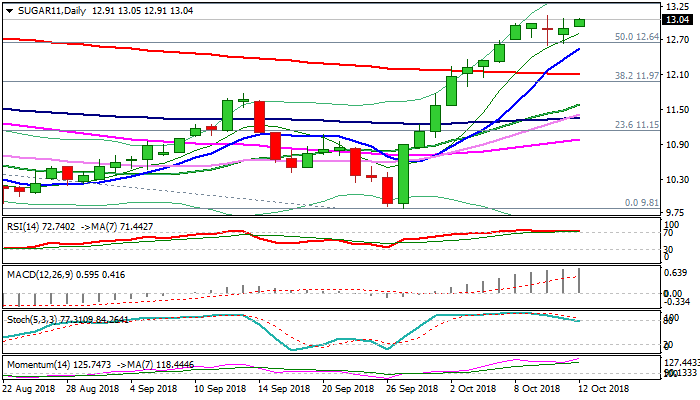

Sugar price probes again above psychological $13.00 barrier on Friday (following short-lived spike to $13.11 on 10Oct) signaling continuation of strong three-week uptrend.

Fresh strength emerges after consolidation in past two days and pressures key barriers at $13.09/38 (base of falling weekly cloud / Fibo 61.8% of $15.47/$9.81), violation of which would generate strong bullish signal.

Bullish techs support the action, but fundaments are likely the main driver of sugar price.

News that global sugar market could turn to deficit as Brazil and the EU cut production, affected by very low prices (sugar hit the lowest since mid-2007) could spark further rise of sugar price.

The price was up over 20% in past three weeks on acceleration from 27 Sep low at $9.81 and shows no signs of fatigue for now.

Firm break above $13.09/31 pivots) and lift above weekly cloud top ($13.62) would open way towards $14.13 (Fibo 76.4% of $15.47/$9.81 descend) and $14.52 (falling weekly 100SMA).

Two-day consolidation lows at $12.60 mark initial support (reinforced by rising 10SMA), guarding pivotal support at $12.09 (broken 200SMA).

Res: 13.09; 13.31; 13.62; 14.13

Sup: 12.91; 12.60; 12.34; 12.09