Bulls regained traction but eye US inflation gauge data for more signals

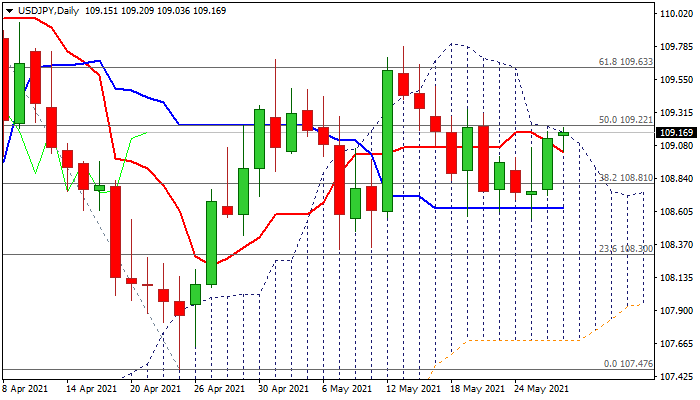

The dollar maintains positive near-term tone following Wednesday’s 0.34% jump (the biggest one-day gains since May 12) and probes through daily cloud top 109.16, as Thursday’s action is establishing above 109 mark.

Firm break of cloud top would add to positive signals, as the dollar is lifted by month-end increased demand.

Rising bullish momentum on daily chart supports the action which left a higher base at 108.60 zone after multiple downside attempts were contained by daily Kijun-sen.

Emerge above daily cloud would expose key barriers at 109.69/78 (May 3/13 high), violation of which would confirm reversal from 107.47 (low of 110.96/107.47 pullback, posted on Apr 23).

Traders focus on Friday’s release of US inflation gauge – core PCE deflator- which could strongly inflate the greenback on above expectations figure (Apr f/c 2.9% from 1.8% in March) as strong numbers would boost dollar-positive speculations about the Fed starting to reduce bond purchases on rising inflation.

Conversely, weaker than expected Apr number would weaken dollar on uncertain taper timeline.

Res: 109.22; 109.33; 109.63; 109.78

Sup: 109.03; 108.72; 108.60; 108.35