Near-term structure weakens but fresh bears need more evidence to signal pullback

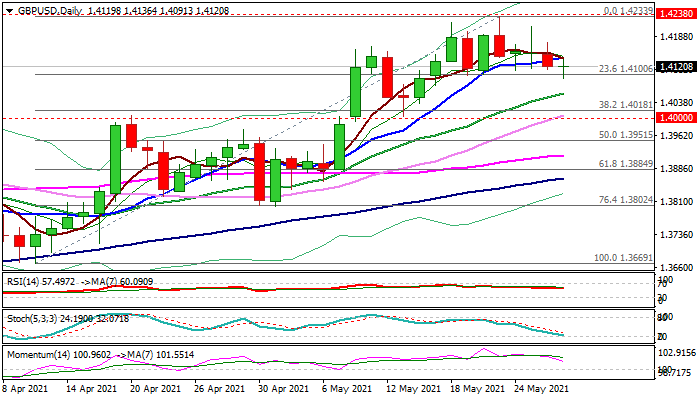

Cable stands at the back foot in European trading on Thursday and cracked important 1.4100 support (Fibo 23.6% of 1.3669/1.4238 rally), but so far lack strength to break lower and confirm signal.

Wednesday’s bearish acceleration and close below 10DMA (1.4140) generated initial bearish signal after Mon/Tue long-legged Dojis signaled strong indecision.

Significant loss of bullish momentum on daily chart and formation of 5/10DMA bear-cross weighs on near-term action

Firm break of 1.41 handle would risk deeper pullback through 20DMA (1.4057) and test of key supports at 1.4018/00 (Fibo 38.2% of 1.3669/1.4233 / psychological) would damage larger bullish structure.

Extended consolidation could be expected while 1.41 support holds, with return and close above 10DMA to ease downside risk and shift focus towards the upper part of the range that extends into ninth day.

Res: 1.4142; 1.4175; 1.4210; 1.4238

Sup: 1.4100; 1.4057; 1.4018; 1.4000