Oil eases after double-Doji, but signals remain mixed

WTI oil price edged lower on Thursday but remains within a narrow range that extends into third day and consolidating strong rally of last Mon/Fri (up 6.5%).

Oil remains supported by expectations for stronger demand on summer driving season in Europe and the United States that so far counters concerns about lower demand from India on new wave of coronavirus and fears that Iran’s return to the market would further increase supply.

Bigger than expected draw in US oil inventories join positive factors which keep oil prices inflated.

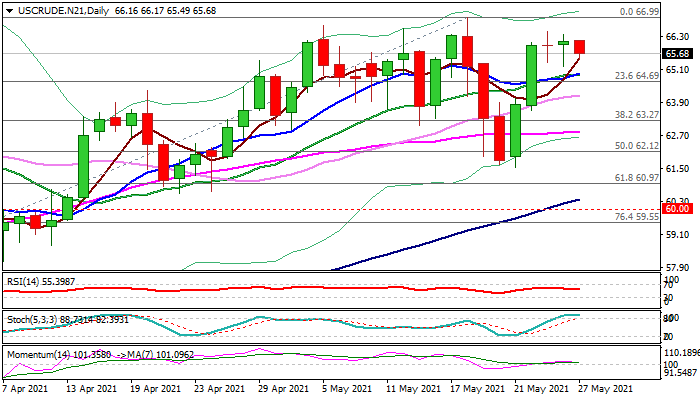

On the other side, daily technical studies are mixed as moving averages remain in bullish setup, but positive momentum is fading and stochastic is about to emerge from overbought territory that warns about recovery stall after Tue/Wed double-Doji signaled indecision.

Initial support t $65.31 (Fibo 23.6% of $61.54/$66.48 upleg / Wed/Tue lows) is under pressure and guarding converged 10/20DMA’s ($64.98) with near-term bias expected to remain with bulls while these supports hold.

Caution on extension below $64.59 (Fibo 38.2%), clear break of which would signal reversal and bring bears back to play.

Res: 66.48; 66.99; 67.50; 67.95

Sup: 65.31; 64.98; 64.59; 64.18