Bulls tighten grip and look for retest of 2022 high

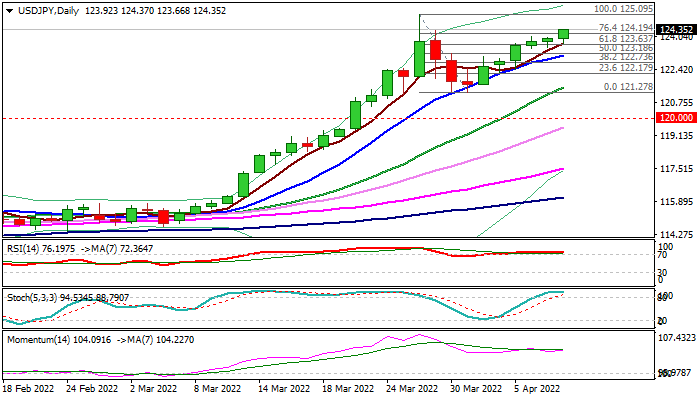

The USDJPY continues to trend higher and extend uninterrupted recovery from a higher base at 121.27 (Mar 30/31) into sixth straight day, on track for the fifth consecutive strong weekly gains.

Today’s acceleration cracked pivotal Fibo resistance at 124.19 (76.4% of 125.09/121.27 pullback) close above which would confirm that corrective phase is over.

Bulls pressure the last obstacle at 124.30 (Mar 29 high), to open way for test of 125.09 (2022 peak), the highest in nearly 7 years and key longer term barrier at 125.84 (2015 high).

Technical studies are firmly bullish on daily and weekly chart, pointing to underlying bullish structure, however, overbought conditions on both timeframes, warn that bulls may pause for a consolidation under key barriers before resuming.

Dips should offer better buying levels, with solid supports at 123.10/122.70 expected to ideally contain, although deeper dips cannot be ruled out.

Near-term bias will remain with bulls while the action holds above key support at 121.27, but caution if the price approaches this level, as break lower would sideline bulls on completion of daily failure swing pattern.

Res: 124.50; 125.09; 125.84; 126.50

Sup: 123.60; 123.10; 122.70; 122.20