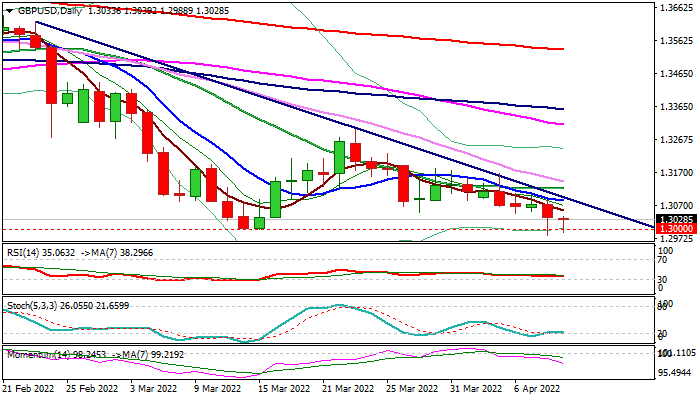

Bears probe again through key 1.30 support as downbeat UK GDP adds to negative sentiment

Cable remains in a negative mode in early Monday and probed again through key 1.30 support (psychological / Mar 15 low), following last Friday’s short-lived dip to 1.2982 (the lowest since Nov 2020).

Rising US dollar keeps the pound in defensive, while weaker than expected UK Feb GDP data added pressure to the currency, threatening of a final clear break of 1.30 pivot that would risk extension towards 1.2855/ 20 zone (lows of Nov/Oct 2020 respectively).

Quick bounce from the levels below 1.30 on Friday / today, signals that bears face strong headwinds here and may struggle further in attempts to break lower, however, near-term action remains biased lower and extended consolidation is likely to precede fresh leg lower.

The notion is supported by rising negative momentum on daily chart and moving averages in full bearish setup, with upticks to offer better selling opportunities while holding below 1.3100 zone (falling 10DMA / trendline resistance / Fibo 38.2% of 1.3298/1.2982 bear-leg).

Res: 1.3054; 1.3085; 1.3102; 1.3140

Sup: 1.3000; 1.2982; 1.2900; 1.2855