Cable falls to one-week low and risks deeper drop on break of pivotal supports

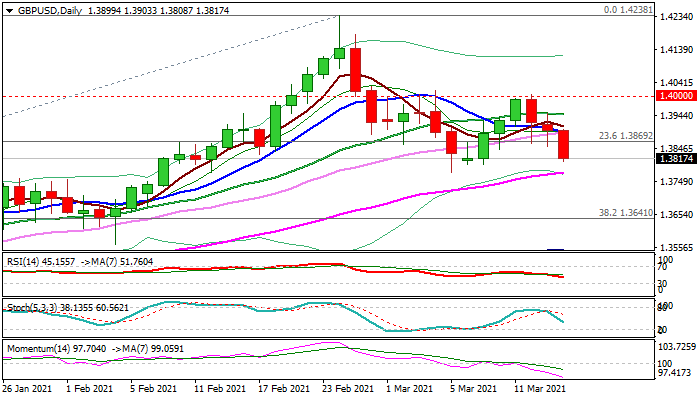

Cable was sold in early Tuesday’s trading and fell to one-week low, confirming negative near-term bias after long tails of candles in past two days suggested that fresh bears from a double rejection at 1.40, face headwinds.

Sterling came under increased pressure from EU’s legal action against the UK over North Ireland that added to negative signals from weakening daily studies.

Strong bearish momentum and daily moving averages (10/20/30) turning to bearish setup, as well as eventual break of Fibo support at 1.3869 (23.6% of 1.2675/1.4238) weigh on pound.

Bears pressure pivotal supports at 1.3778 (Mar 5 low / rising 55DMA), break of which would also complete failure swing pattern and generate strong bearish signal for extension towards key supports at 1.3687/41 (top of rising daily cloud / Fibo 38.2% of 1.2675/1.4238 ascend).

Broken Fibo support (1.3869) and converged 10/30DMA’s (1.3895, which attempt to form bear-cross) reverted to solid resistances which need to cap and maintain bearish bias.

Res: 1.3869; 1.3895; 1.3945; 1.4000

Sup: 1.3778; 1.3700; 1.3687; 1.3641