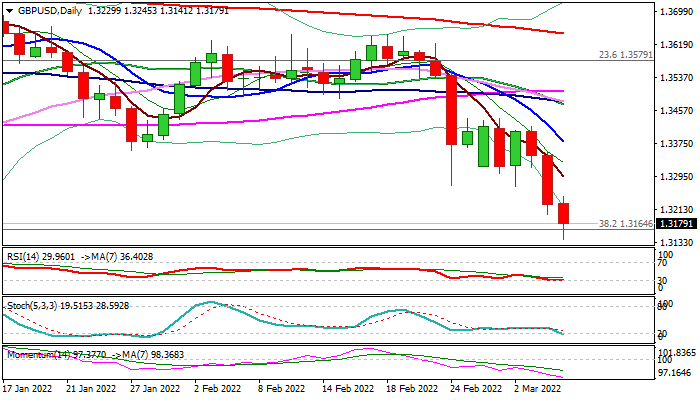

Cable hits a 15-month low on probe through key supports

Cable remains firmly in red on Monday and extends steep fall into third straight day, dragged by fresh risk aversion that pushed global stocks lower.

After last week’s strong upside rejection and weekly close below pivotal 1.33 support (the pair was down 0.7% for the week), bears cracked next significant supports at 1.3164/61 (Fibo 38.2% of 1.1409/1.4249 / Dec 8 low), marking full retracement of 1.3161/1.3748 upleg and pressuring another key level at 1.3121 (200WMA).

Earlier completion of failure swing pattern on daily chart added to strong bearish stance, with firm break of 1.3161 pivot to complete larger failure swing pattern on weekly chart and generate stronger bearish signal for extension towards 1.3000 (psychological) and 1.2829 (50% retracement of 1.1409/1.4249.

Firmly bearish daily studies support scenario, however bears may face headwinds on oversold condition and hold for consolidation before resuming.

Bears are expected to remain in play as long as price action stays below broken 1.3300 support, now reverted to strong resistance.

Res: 1.3245; 1.3272; 1.3300; 1.3320

Sup: 1.3161; 1.3141; 1.3106; 1.2950