Cable remains at the back foot ahead of key UK inflation data

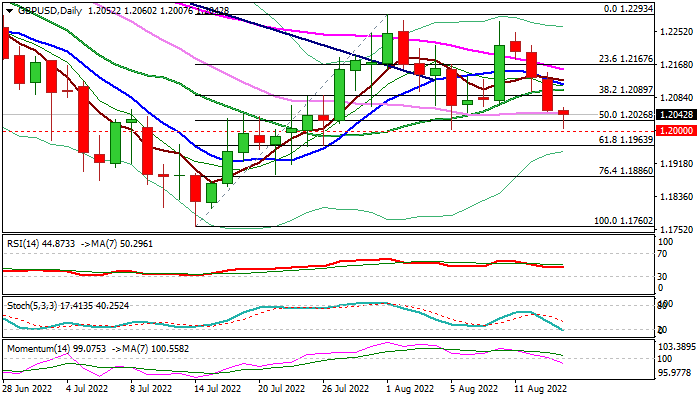

Bears extend into fourth consecutive day and probe through important support at 1.2026 (50% of 1.1760/1.2293 upleg / daily Kijun-sen), pressuring psychological 1.20 support.

Technical structure on daily chart is negative (MA’s in bearish setup / 14-d momentum extending lower in negative territory), supporting scenario of break below pivotal 1.20 zone that would complete a double-top pattern on daily chart (1.2293/76) and signal an end corrective phase from 1.1760 (July 14 low, the lowest since March 2020).

Bears are expected to remain in play as long as the action stays below pivotal 1.21 resistance zone (broken Fibo 38.2% / 20DMA).

Data released today show that UK labor market shows more signs of cooling, while investors shift focus to UK inflation data, due to be released tomorrow.

According to forecasts, July consumer prices are expected to hit new multi-decade high at 9.8% that raises probability for a second consecutive 0.5% rate hike by BOE, in attempts to battle soaring inflation, which the central bank expects to exceed 13% in October.

Despite expectations that higher interest rates would inflate pound, the currency may fail to benefit as higher borrowing cost is likely to hurt economic growth.

Res: 1.2060; 1.2089; 1.2106; 1.2148

Sup: 1.2026; 1.2000; 1.1963; 1.1916