Cable remains in red on dollar’s rebound and UK GDP miss

Cable extends weakness on Tuesday following previous day’s strong fall (down 0.66% for the day) pressured by stronger dollar and UK GDP data miss (May 1.8% vs 5.5% f/c).

Strong rebound of dollar on rising virus cases that prompted officials to impose new restriction measures in California and persisting US/China conflict, hurt risk sentiment.

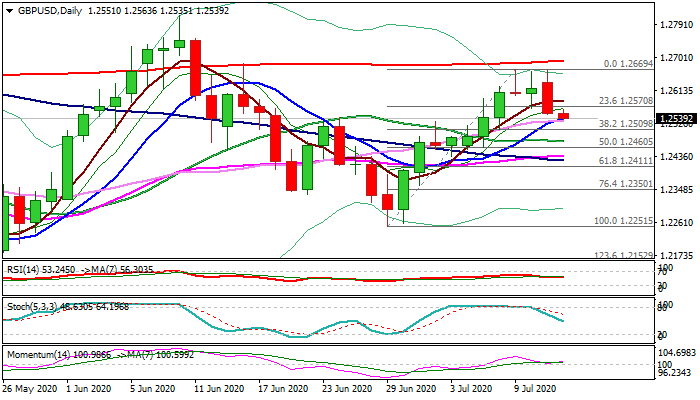

Fresh weakness cracked support at 1.2530 (10DMA) and pressures pivotal level at 1.2509 (Fibo 38.2% of 1.2251/1.2669 upleg).

Near-term risk is shifting to the downside following formation of triple-top pattern on daily chart and Monday’s strong bearish close after last week’s shooting star (Thu) and Doji (Fri).

Violation of 1.2509 pivot would open way for bearish extension towards 1.2477 (20DMA) and 1.2460 (50% retracement / daily cloud top).

Res: 1.2570; 1.2584; 1.2600; 1.2638

Sup: 1.2529; 1.2509; 1.2477; 1.2460