Cable remains volatile and looks for clearer direction signals

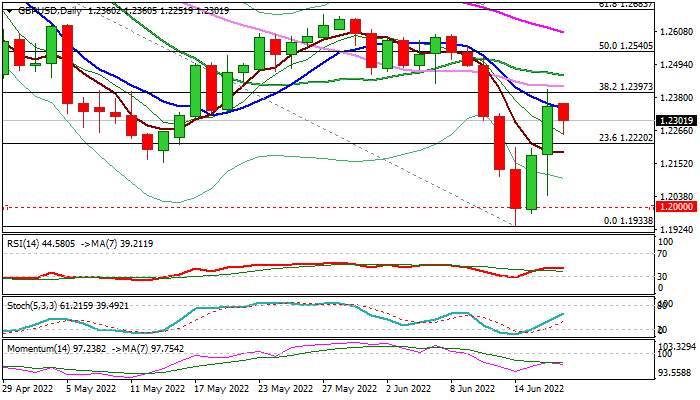

Cable eases in early Friday, following strong rebound in past two days which lost traction at the first strong obstacle at Fibo 38.2% of 1.3147/1.1933 descend, denting initial signal of reversal.

Sterling was boosted by BOE’s rate hike by 25 basis points to 1.25% (the fifth rate increase since December) and hawkish shift in central bank’s expectations, but remains highly volatile.

Cable remains supported by BOE’s action and strong headwinds that bears faced at psychological1.20 support, but overall strong dollar continues to weigh.

Daily studies remain bearishly aligned, as negative momentum remains strong and MA’s are in bearish setup, though initial positive signal is developing on formation of long-tailed Doji or possible hammer candlestick and bear-trap under 1.20 level.

Look for clearer direction signals, which would be generated on drop and close below 5 DMA (1.2191) that would weaken near-term structure and risk renewed attack at 1.20 zone, or sustained break above Fibo 38.2% barrier at 1.2397 which would signal further advance.

Res: 1.2397; 1.2420; 1.2456; 1.2540

Sup: 1.2220; 1.2191; 1.2155; 1.2099