USDJPY returns to strength after shallow pullback

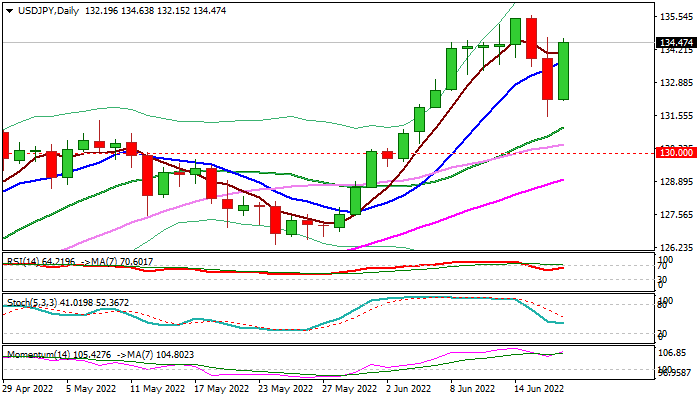

The dollar regained traction and bounced on Friday, after two-day pullback from new highest since 1998 was contained by Fibo support at 132.05 (38.2% of 126.36/135.57 upleg.

The sentiment for yen was soured by today’s Bank of Japan’s decision to keep their monetary policy unchanged that would further widen the gap between hawkish Fed and neutral BoJ.

Strong bullish acceleration in early Friday has already retraced 76.4% of 135.57/131.49 pullback, suggesting that corrective phase is likely over.

Daily tech returned to full bullish setup and underpin the action for attack Wednesday’s peak at 135.57, violation of which would open way for further advance towards Fibo projections at 136.13 and 138.00.

On the other side, overbought conditions and fading bullish momentum on weekly chart, along with formation of weekly Doji candle, require caution.

Broken 10DMA offers initial support at 133.78, followed by pivotal supports at 131.49 (correction low) and 131.05 (20DMA) loss of which would weaken near-term structure.

Res: 135.16; 135.57; 136.13; 138.00

Sup: 134.00; 133.78; 132.75; 131.49