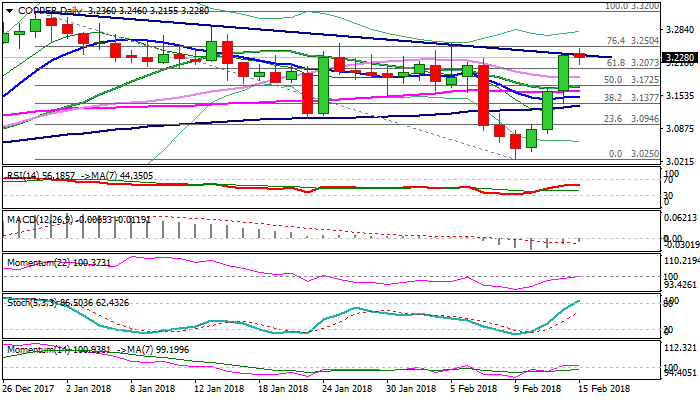

COPPER – profit-taking after strong rally slows bulls

Copper trades in narrow consolidation under new marginally higher high at $3.2460, posted after strong three-day rally from $3.0250 (09 Feb low).

Rally accelerated on Tue/Wed on fresh weakness of the dollar and surged through thick daily cloud and a number of daily MA’s, retracing nearly 76.4% of $3.3200/$3.0250 bear-leg and generating strong bullish signal.

Profit-taking after strong rally could slow bulls, along with overbought slow stochastic. Also, lower liquidity on reduced participation of Chinese traders due to Lunar New Year could cause stronger movements in the market.

Today’s close in red would initial signal of bulls taking a breather, however, firm bullish structure suggests limited dips (ideally to be contained by daily cloud top ($3.1956), before bulls continue through immediate barriers at $3.2504 (Fibo 76.4% of $3.3200/$3.0250 descend) and double-top at $3.2565/60 (25 Jan / 05 Feb).

Plethora of supports provided by daily MA’s lies below cloud top and supports scenario.

Res: 3.2504; 3.2565; 3.2750; 3.2900

Sup: 3.2155; 3.1956; 3.1185; 3.1714