Crude price continues to fall despite price cap on Russian oil

WTI oil price holds firmly in red for the third straight day and hit one week low in European trading on Tuesday, pressured by stronger dollar and recession fears which so far offset expected impact from G7 decision to cap the price of Russian oil.

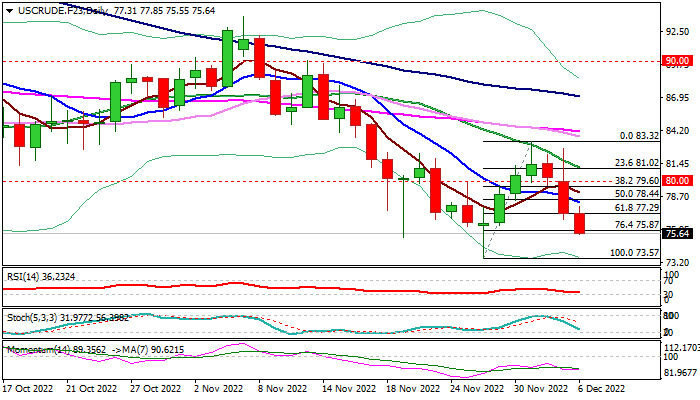

Negative technical studies add to near-term outlook, as daily MA’s are in full bearish setup and negative momentum is strong.

Fresh acceleration lower from Dec 1 recovery top ($83.32) emerged after bulls got trapped above Fibo barrier at $81.27 (38.2% of $93.72/$73.57) and reversed so far 76.4% of $73.57 $83.32 recovery leg, on track to fully retrace correction from $73.57 (Nov 28 low, the lowest since late Dec 2021) to $83.32 (Dec 1 high).

Loss of $73.57 handle would expose next significant support at $73.03 (200MMA) which guards psychological $70 support and $68.50 (50% retracement of $6.52 $130.48 recovery phase).

Res: 76.26; 77.29; 77.85; 78.44

Sup: 75.26; 73.57; 73.03; 70.00