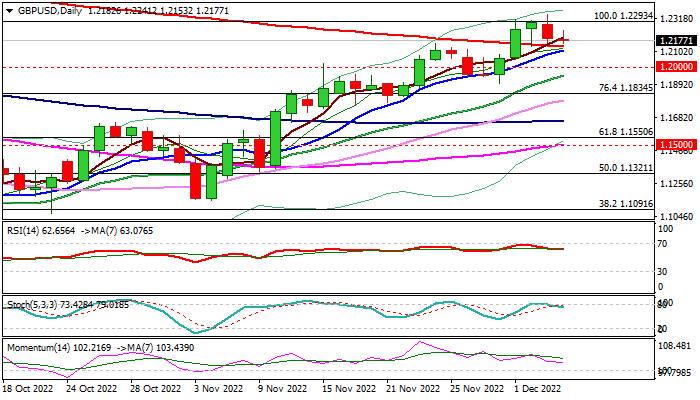

Cable is consolidating under multi-month high, technical signals are mixed

Cable is standing at the back foot on Tuesday, following a bearish close on Monday after bulls failed to hold gains above pivotal barrier at 1.2293 (former top of Aug 1), but dips remain limited and facing headwinds from 200DMA (1.2135), reinforced by approaching rising 10DMA, in attempt to form a Golden-cross.

The pullback is so far shallow, suggesting that bulls are consolidating before renewed probe through 1.2293 barrier, however dip below 200 DMA cannot be ruled out, with psychological 1.20 support to ideally hold and point to a healthy correction, which would live larger bulls unharmed.

Technical studies are mixed on daily chart, as moving averages remain in bullish setup, positive momentum is fading and the indicator also showed bearish divergence, while stochastic emerged from overbought territory.

Initial negative signal to be expected on break of converged 200/10DMA’s (1.2135/1.2110) and boosted on dip through 1.20, with extension below 1.1900 (Nov 30 trough) to open way for deeper pullback.

Conversely, sustained break of 1.2193 pivot to signal bullish continuation and expose key Fibo barrier at 1.2449 (Fibo 61.8% of 1.3748/1.0348).

Res: 1.2241; 1.2293; 1.2344; 1.2406

Sup: 1.2135; 1.2110; 1.2000; 1.1950