Dollar finds ground after post-NFP fall; US inflation data in focus

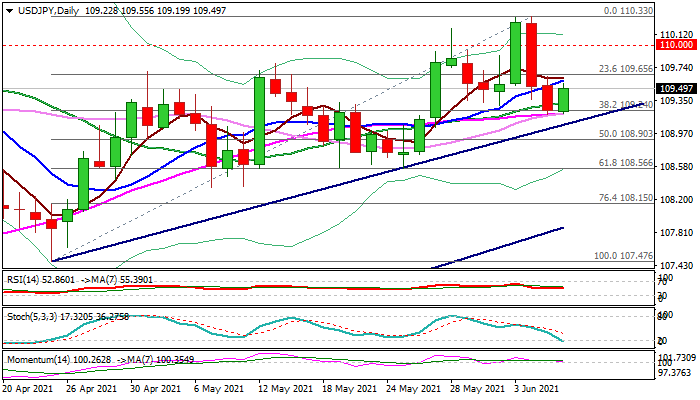

The dollar regained traction on Tuesday after strong fall in past two days, sparked by softer than expected US jobs data, found footstep at 109.20 zone (Fibo 38.2% of 107.47/110.33/ converged 30/55DMA’s).

The pullback from new two-month high at 110.33 so far looks like a healthy correction and keeps the uptrend from 107.47 (Apr 23 low) intact.

Investors focus on US inflation data on Thursday for fresh direction signals, after NFP miss eased expectations about early tapering of the Fed’s monetary stimulus.

Daily techs are overall positive with broader bulls expected to remain in play while pivotal 109.20 support zone holds, but recovery needs close above daily Tenkan-sen (109.68) to be confirmed.

Caution on loss of 109.20 pivot that would risk fresh acceleration towards the higher base / Fibo 61.8% support at 108.56.

Res: 109.68; 109.78; 110.00; 110.33

Sup: 109.20; 108.90; 108.56; 108.33