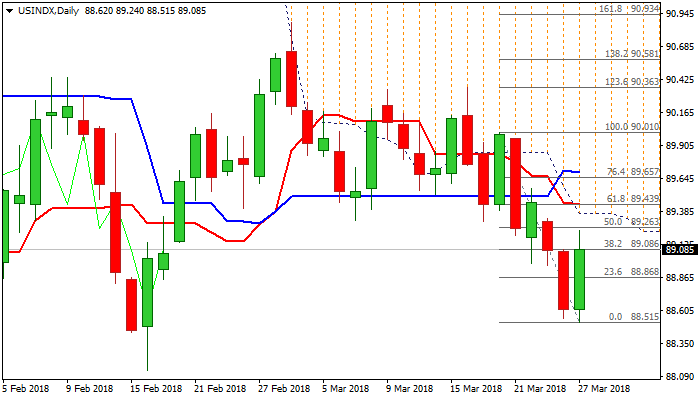

DOLLAR INDEX – base of thick daily cloud marks strong obstacle for fresh recovery rally

The dollar rallies on Tuesday, boosted by fading fears about trade war between the US and China. The dollar index accelerated from 88.50 zone where weakness of past three weeks found support and subsequent bounce signals formation of base.

Fresh rally already retraced losses from the previous day and generated initial bullish signal on break above pivotal barrier at 89.08 (Fibo 38.2% of 90.01/88.51 bear-leg).

Today’s rally is on track to form bullish outside day which would generate fresh signal for stronger recovery.

Fresh bullish sentiment is building and could help for further recovery, however, firmly bearish daily techs warn of possible recovery stall, as very thick daily cloud heavily weighs.

Cloud is spanned between 89.37 and 91.16 and strong barrier provided by cloud base is reinforced by falling 10SMA and Fibo 61.8% of 90.01/88.51 (89.45).

Close above here is required to generate stronger bullish signal of extended recovery.

Caution on repeated failure under cloud base (falling daily cloud caps upside attempts and maintains strong bearish pressure since 01 Mar), which could signal fresh weakness and shift near-term focus lower.

Res: 89.24; 89.45; 89.85; 90.01

Sup: 88.86; 88.50; 88.24; 88.14