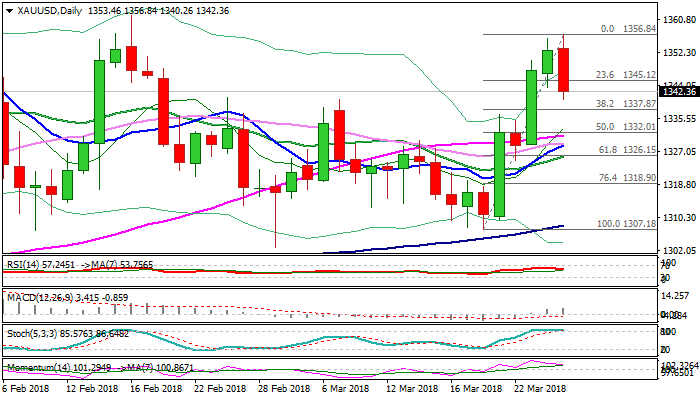

SPOT GOLD – pullback on stronger dollar faces strong support from thick daily cloud top

Spot Gold pulled back from new high at $1356 (the highest since 16 Feb) on Tuesday, as fresh strength of the US dollar on hopes that stronger conflict between US and China regarding tariffs could be avoided, pressured yellow metal’s price.

Renewed risk appetite reduced demand for safe-haven assets, resulting in gold price falling around 1% so far.

Pullback tested support at $1340 (former highs of 26 Feb / 07 Mar) and pressures strong supports at $1337/35 (Fibo 38.2% of last week’s $1307/$1356 rally / daily cloud top) break of which could generate stronger bearish signal for extend correction.

Slow stochastic is reversing in overbought territory on daily chart and would additionally support fresh bears.

However, daily techs are in full bullish setup and current pullback looks like corrective action ahead of fresh upside, with extended dips to be ideally contained by the top of thick daily Ichimoku cloud.

Bearish scenario sees penetration of daily cloud and test of cluster of MA supports between $1331 and $1325, break of which is needed to confirm reversal.

Res: 1345; 1350; 1356; 1361

Sup: 1340; 1337; 1335; 1331