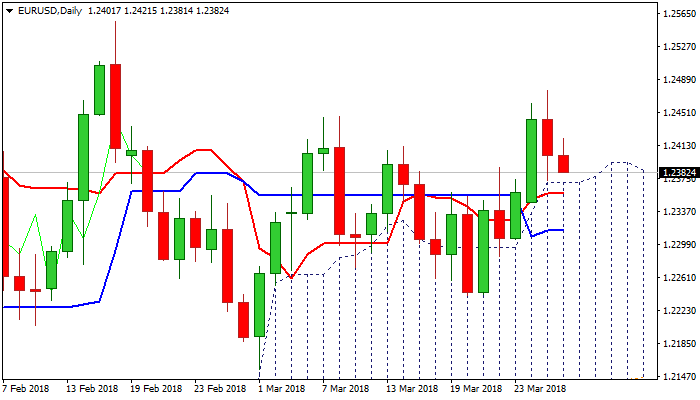

EURUSD – pullback pressures key support – top of thick daily cloud

The Euro stands at the back foot on Wednesday and hit session low at 1.2383, just above key support – top of thick daily cloud.

Weaker than expected EU data on Tuesday and fresh strength of the greenback on easing fears about trade war, weighed on the single currency, which ended Tuesday’s trading in red.

Fresh weakness off Tuesday’s new high at 1.2472 was so far held by 1.2386 support (Fibo 38.2% of 1.2241/1.2476 upleg) which guards strong cloud top support.

The pair needs to hold above daily cloud to keep overall bulls intact. Fresh bullish momentum is building on daily chart and supporting scenario.

Conversely, penetration of daily cloud would delay bulls for deeper pullback which could extend towards a cluster of daily MA’s at at 1.2340/30 zone, which mark next key supports.

Today’s calendar shows no significant releases from the Eurozone and focus will turn towards US GDP and housing data, due later today.

The US economy is expected to grow in Q4 according to the forecast at 2.7% vs 2.5% in Q3, while pending home sales are expected to rise by 2.1% in Feb after falling by 4.7% previous months.

Upbeat numbers from US releases today could be supportive for the greenback.

Res: 1.2421; 1.2446; 1.2461; 1.2476

Sup: 1.2370; 1.2358; 1.2330; 1.2305