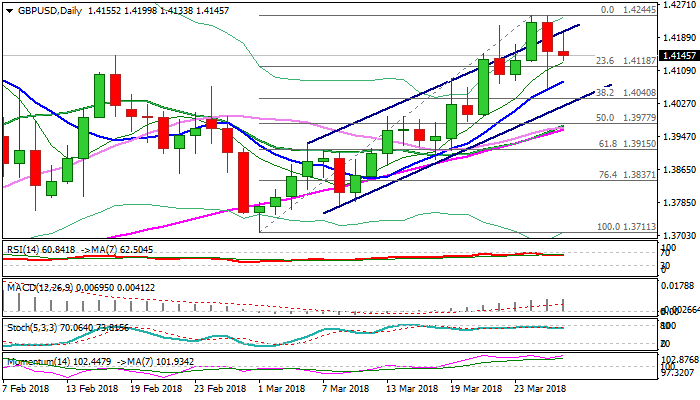

GBPUSD – bullish outlook above rising 10SMA

Cable holds in red in early Wednesday’s trading and capped by the upper boundary of bull-channel.

Double rejection at 1.4244 on Mon/Tue and Tuesday’s bearish close signal double-top formation which could trigger further easing, as profit-taking on month / quarter end would put sterling under increased pressure.

On the other side, yesterday’s strong downside rejection at 1.4065, where rising 10SMA contained dip and subsequent bounce left long-tailed daily candle, could be supportive.

Daily studies are firmly bullish and supportive for fresh advance, with key supports at 1.4080/40 (rising 10SMA / Fibo 38.2% of 1.3711/1.4244 rally) required to hold extended dips and keep bulls in play.

Res: 1.4200; 1.4218; 1.4244; 1.4277

Sup: 1.4133; 1.4080; 1.4065; 1.4040