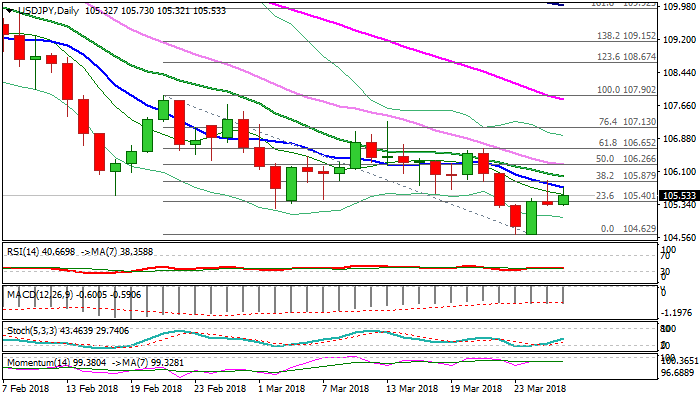

USDJPY – downside remains vulnerable while falling 10SMA caps recovery

Recovery action from 104.63 low shows signs of stall after Tuesday’s extension higher was strongly rejected at key double-Fibonacci barrier at 105.87 (Fibo 61.8% of 106.64/104.63 / Fibo 38.2% of 107.90/104.63 descend) and capped by falling 10SMA.

Negative signal also comes from formation of Shooting Star on daily chart, with firmly bearish daily techs supporting the notion.

The downside is expected to remain vulnerable while the price action stays capped by falling 10SMA (currently at 105.73).

Sustained break higher would provide relief, however, recovery extension needs break above falling 30 SMA which tracks descend since early Jan (currently at 106.27) to generate stronger bullish signal and sideline existing bearish threats.

Res: 105.73; 105.87; 106.00; 106.27

Sup: 105.32; 105.24; 105.00; 104.63