Dollar index falls to two-week low as stimulus hopes and optimistic news on Trump’s health condition, boost risk appetite

The dollar was deflated by fresh risk appetite on Monday, sparked by optimistic news over President Trump’s health condition and hopes on new stimulus deal.

The dollar Index which measures performance of the US dollar against the basket of six major currencies, fell to two week low after news that Trump could be discharged from the military hospital where he is being treated for Covid-19, as early as Monday.

Traders remain optimistic on signs of progress in talks on much needed new fiscal stimulus package although the situation has been further complicated by the news that top Republicans tested positive.

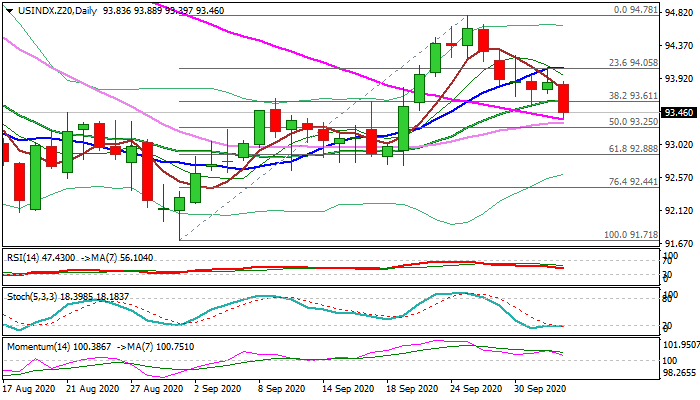

Fresh weakness eventually broke below strong Fibo support at 93.61 (38.2% retracement of 91.71/94.78 upleg, which held the action in past three days) and pressuring converged 30/55DMA’s (93.31/36).

Fading bullish momentum on daily chart and 5/10/20DMA’s in bearish setup, supports the notion

Daily close below 93.61 pivot is needed for bearish signal, which would be confirmed on break below moving averages and open way towards next key supports at 93.25 (daily Kijun-sen) and 92.91 (daily cloud base).

Res: 93.61; 93.88; 94.05; 94.23

Sup: 93.25; 92.91; 92.74; 92.44