Dollar regains traction on fresh safe-haven buying

The dollar index extends acceleration from last Friday and hits one-week high in early Monday, lifted by renewed risk aversion.

Traders move into safety on fresh rise in new Covid cases in China, which prompted tighter restrictions, with capital Beijing most populous districts being hit the most.

China’s zero-Covid tolerance policy drives the volatility higher in such situation, as tough restrictions impact economic activity and markets await signals whether the government will start easing its policy soon.

Fresh safe-haven buying lifted the dollar index, signaling fresh direction after the price was in sideways mode last week, consolidating recent strong fall.

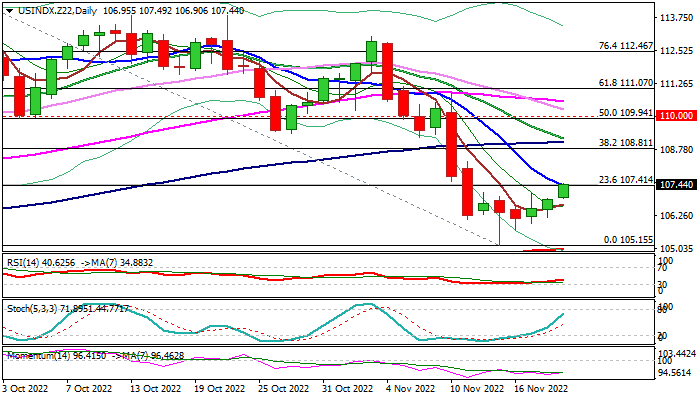

Initial reversal signals are developing on daily chart as fresh gains cracked first pivot at 107.41 (Fibo 23.6% of 114.72/105.15 fall, reinforced by 10DMA), with sustained break here to firm near-term structure and expose next important barriers at 108.81/109.05 (Fibo 38.2% / 100DMA).

North-heading daily indicators support the action, though momentum is still deeply in the negative territory, but weekly bear-trap under Fibo 61.8% of 101.29/114.72) underpins the action.

Recovery needs lift through 109 zone and violation of the base of thick daily cloud (109.61) to confirm reversal signal and open way for further recovery.

Otherwise, recovery will remain fragile and at risk of stall that would signal better opportunities to re-enter larger downtrend off Sep 29 peak (114.72).

Res: 108.30; 108.81; 109.05; 109.61

Sup: 107.90; 106.68; 105.70; 105.15