Dollar’s pullback faces headwinds at key supports but negative signals prevail

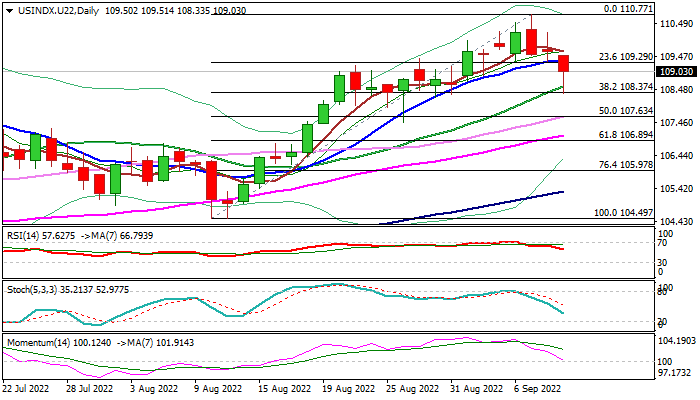

The dollar holds in red for the third straight day, though the pullback from new 20-year high, posted on Wednesday, faced strong headwinds at 108.56/37 zone (rising 20DMA / Fibo 38.2% of 104.49/110.77 upleg).

The dollar is taking a breather after recent strong rally, fueled by safe haven flows and expectations that Fed will remain aggressive in coming months, as fighting soaring inflation is central bank’s top priority, however, yesterday’s 75 basis points by the central bank’s of the EU and Canada, sightly faded the shine of Fed’s recent actions.

Fresh bears generated initial negative signal on dip below 10DMA (109.34), but confirmation of signal will require a clear break of 108.56/37 pivots.

South-heading daily indicators and 14-d momentum about to break into negative territory, add to bearish near-term stance, with overbought conditions and formation of bearish engulfing pattern on weekly chart, also contributing to negative signals.

Break of 20DMA would risk extension of pullback towards next key support at 107.63 (50% retracement / daily Kijun-sen).

Broken 10DMA reverted to solid resistance which should keep the upside protected to maintain near-term bearish bias, while sustained break higher would signal that corrective phase might be over.

Res: 109.34; 110.00; 110.22; 110.77

Sup: 108.56; 108.37; 107.92; 107.63