Euro eases after ECB as stimulus and solid jobs data lift dollar

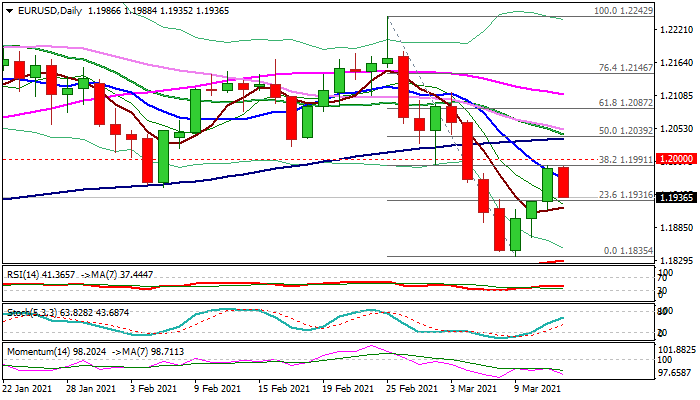

The Euro was sold in early Friday’s trading following a double rejection at key resistance zone at 1.1991/1.2000 (Fibo 38.2% of 1.2242/1.1835 bear leg / psychological).

Traders digested ECB’s decision to keep overall policy package unchanged, speed-up bond buying in coming quarter and commitment to keep borrowing cost down, while final approval of President Biden’s $1.9 trillion stimulus package lifted US Treasuries and dollar, with greenback being additionally supported by stronger than expected drop in weekly jobless claims that boosts hopes for acceleration in the US labor sector’s recovery.

Fresh weakness raises fears that near-term correction off 1.1835 (March 9 low) might be over, with today’s close below 1.1930 (double Fibo level – broken 23.6% of 1.2242/1.1835, reverted to support and 38.2% of 1.1835/1.1990 upleg) to add to negative near-term signals and shift focus lower.

Fresh negative momentum on daily chart and moving averages in bearish setup, support the notion.

Only firm break above 1.20 zone would neutralize downside risk and open way for stronger correction of 1.2242/1.1835 descend.

Res: 1.1952; 1.1990; 1.2000; 1.2040

Sup: 1.1930; 1.1912; 1.1894; 1.1868