Euro holds firm bearish tone ahead of Fed

The Euro remains firmly in red at the beginning of the week and extends sharp fall from last Thu/Fri, hitting new one-month lows in European trading on Monday.

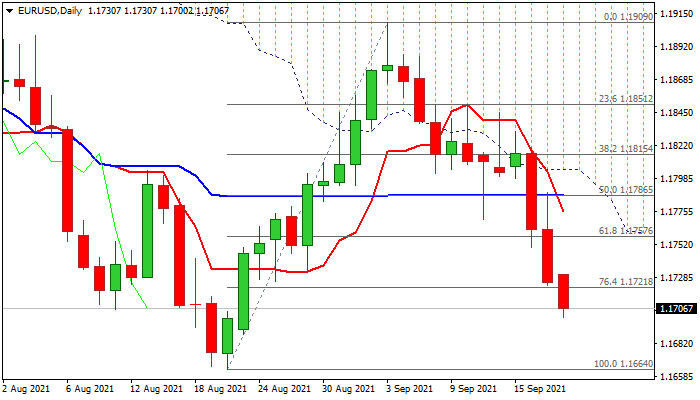

The pair keeps firm bearish tone following 1.3% drop in past two weeks as bears accelerated after bull-trap above Fibo barrier at 1.1894 in early September.

Falling thick daily cloud continues to heavily weigh on near-term action which is pressuring pivots at 1.1700/1.1694 (psychological / Fibo 38.2% of 1.0635/1.2349 rally) and focusing key support at 1.1664 (2021 low posted on Aug 20), loss of which could risk drop towards 1.1600/1.1500 zone.

Rising bearish momentum, daily MA’s in negative setup and forming a number of bear-crosses, add to bearish picture.

Oversold conditions on daily chart may slow bears, as traders also await fresh signals from Fed’s policy meeting which ends on Wednesday.

Upticks are expected to provide better selling opportunities while remain capped by falling daily Tenkan-sen (currently at 1.1775).

Res: 1.1721; 1.1757; 1.1775; 1.1786

Sup: 1.1694; 1.1664; 1.1602; 1.1500