Euro keeps firm tone; ECB likely to provide fresh boost

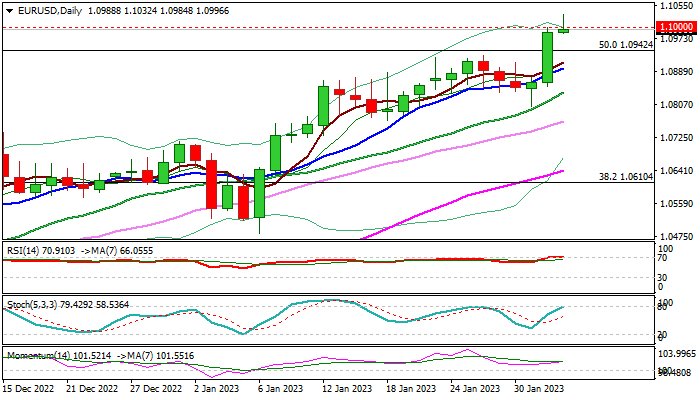

The Euro is holding firm tone in European trading on Thursday and consolidating around psychological 1.10 level, just under new ten-month high (1.1032), hit in extension of Wednesday’s 1.1% advance.

The single currency appreciated after Fed raised rate by 25 basis points, in line with expectations, but markets perceived the action as dovish, giving fresh boost to riskier assets.

Traders shift focus to today’s ECB policy meeting, as the central bank is expected to raise interest rates by another 50 basis points to 2.5% and signal more hikes in coming months.

Many expect that the ECB may follow Fed and start easing the pace of tightening, also partially due to deteriorating bloc’s economic picture, though the signals from policymakers so far point to firm stance and continuing fight against inflation.

Technical structure has significantly improved, following bullish signal on Wednesday’s break and close above the top of thick falling weekly cloud (1.0930) and pivotal Fibo barrier at 1.0942 (50% retracement of 1.2349/0.9535), with today’s probe through psychological 1.10 barrier (for the first time since early April) adding to positive signals.

Bulls eye immediate target at 1.1073 (100WMA), but could accelerate towards 200WMA (1.1224) and Fibo 61.8% (1.1274) if the ECB reaffirms its strong hawkish stance.

Shallow dips should provide better buying opportunities, with bullish bias to remain intact while the price action stays above rising 10DMA (1.0898).

Res: 1.1032; 1.1072; 1.1184; 1.1274

Sup: 1.0942; 1.0898; 1.0838; 1.0800