Euro likely to weaken further after consolidation

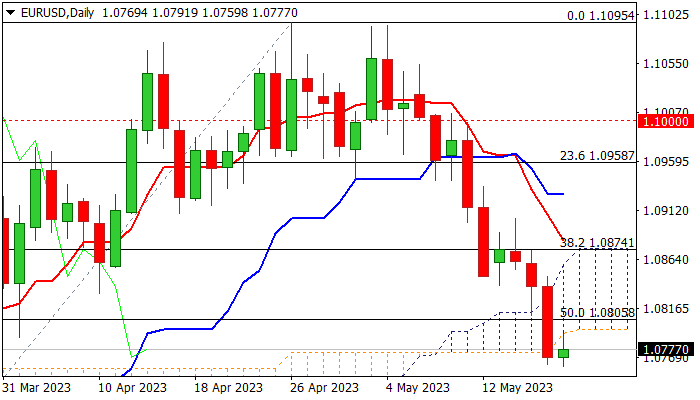

The Euro is consolidating above new multi-week low in early Friday’s trading, as bears take a breather after acceleration on Thursday which resulted in 0.64% daily drop and break of key supports.

Thursday’s close below 1.0805/1.0791 pivots (50% retracement of 1.0516/1.1095 / daily cloud base) generated strong bearish signal and added to negative near-term outlook, opening prospects for further weakness.

The pair is on track for the second consecutive weekly drop, with Friday’s close below daily cloud to confirm signal and keep bears firmly in play for extension towards 1.0737/00 (Fibo 61.8% of 1.0516/1.1095 / psychological).

Negative momentum remains strong on daily chart and moving averages are in bearish setup, though oversold conditions may slow bears for consolidation / limited correction.

Broken cloud base and Fibo 50% reverted to solid resistances which should ideally cap.

Only bounce and close above daily cloud would sideline bears and shift near-term focus to the upside.

Firm dollar on growing optimism about debt ceiling deal and signals that US interest rates will stay higher for some time, add pressure on the single currency.

Res: 1.0791; 1.0805; 1.0874; 1.0884

Sup: 1.0760; 1.0737; 1.0700; 1.0652