Euro looks for renewed attack at cloud base, underpinned by expectations for favorable US CPI numbers

The Euro keeps firm tone in European trading on Tuesday, despite downbeat data from Germany (Aug CPI rose to 7.9% from 7.5% in July / economic sentiment weakened further into Sep and hit the lowest since 2008 recession) as traders expect good news from the US inflation report, due later today.

US inflation is expected to ease further (Aug f/c 8.1% vs July 8.5%) that may impact Fed’s rate hike trajectory, as further easing in price pressures would soften central bank’s current aggressive stance (on track for another 75 basis points hike in Sep meeting.

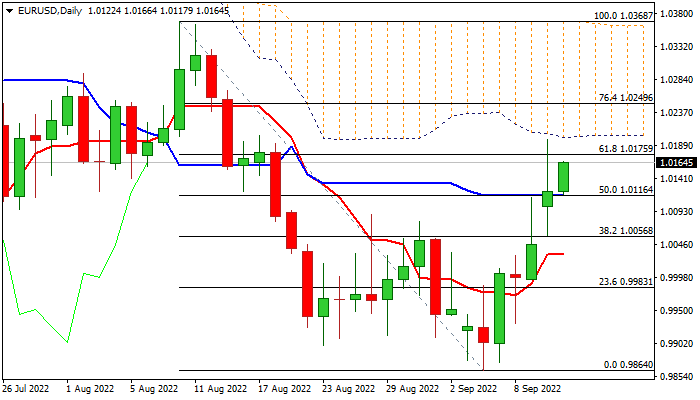

Technical picture shows bulls in play, despite signals of hesitations from long shadows of Monday’s daily candle, as the pair registered a marginal close above 1.0116 (daily Kijun-sen / 50% of 1.0368/0.9864) and looking for another probe through 1.0175 (Fibo 61.8%) that would open way for renewed attack at key barrier at 1.0201 (base of thick daily cloud).

Bullish momentum remains strong on daily chart, adding to positive near-term outlook, though the rally may again face headwinds from the cloud.

Bullish scenario sees penetration and close within the cloud that would unmask next key barriers at 1.0334/68 (falling 100DMA / daily cloud top / lower top of Aug 10).

The pair may hold in extended consolidation if bulls repeatedly stall at cloud base, but the action needs to stay above 1.0116 (reverted to solid support) to keep bullish bias.

Res: 1.0175; 1.0197; 1.0201; 1.0249

Sup: 1.0116; 1.0089; 1.0056; 1.0023