Euro remains constructive and re-tests 1.10 barrier ahead of Fed policy decision

The Euro remains bid in European trading on Wednesday and cracks 1.10 barrier, where the action faced strong headwinds past two days.

Hopes for a breakthrough in peace talks between Russia and Ukraine keep slight risk mode in play, however, all eyes are on today’s Fed policy decision, with markets fully pricing for a first interest rate raise in three years.

The central bank is widely expected to increase interest rates by 0.25%, but there are chances for 0.5% hike, in attempt to tackle soaring inflation.

The dollar is expected to benefit from rate hike, however, traders will be focusing on signals about Fed’s next steps and strength of that message would give more hints about greenback’s short-term direction.

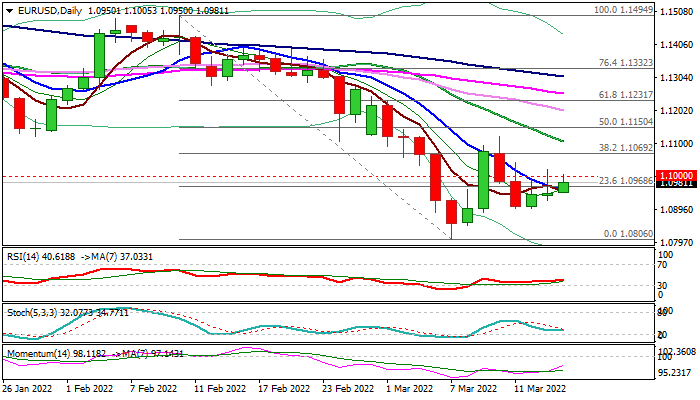

Daily studies are in bearish setup and warn about limited recovery before larger bears resume, with failure to clear 1.10 pivot to keep the downside under pressure and risk test of first pivot at 1.0900 (Mar 14 trough) and expose key level at 1.0803 (Mar 7 low), loss of which would signal bearish continuation.

Conversely, break of 1.10 would ease immediate downside risk, but bulls need to register a clear break of cracked Fibo barrier at 1.1069 (38.2% of 1.1494/1.0806) and extension above recovery top at 1.1121 (Mar 10 spike high) to signal reversal.

Res: 1.1000; 1.1020; 1.1043; 1.1069

Sup: 1.0950; 1.0900; 1.0848; 1.0806