Bulls slow on approach to key barrier, awaiting Fed’s decision

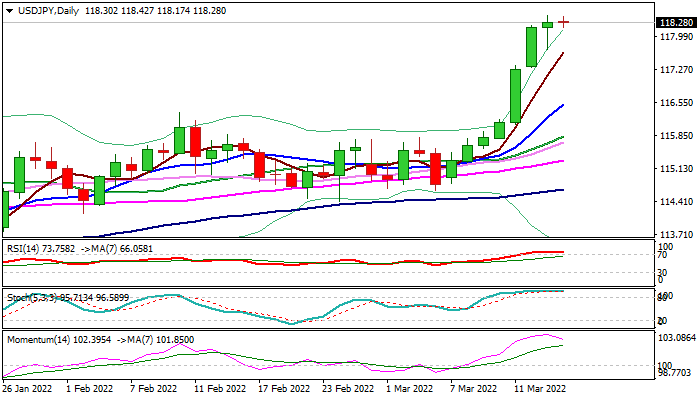

The USDJPY holds firm tone on approach to target at 118.66 (Dec 2016) although bulls slowed after strong rally last Fri/Mon, but Tuesday’s long-tailed daily candle suggests that strong bullish stance remains intact.

The dollar was lifted by expectations for Fed rate hike at today’s end of two-day policy meeting and also by safe-haven buying on uncertainty over the war in Ukraine..

Overbought daily studies warn of consolidation / correction before larger bulls resume, though the action will directly depend on Fed’s verdict.

Hawkish stance with 0.25% (possibly 0.5%) hike and signals of steady rate increases in coming months, would lift the dollar further.

Break of 118.66 pivot would expose Fibo barrier at 119.50 (76.4% of 125.84/98.99) and psychological 120.00 resistance.

Caution on more dovish comments from the US policymakers, as the central bank now faces strong concerns about the impact of the war in addition to the soaring inflation, that would deflate the greenback, in possible ‘buy the rumor – sell the fact’ scenario.

Initial supports lay at 117.70/50, while extension below 117 would harm bulls and signal deeper pullback.

Res: 118.45; 118.66; 119.00; 119.50

Sup: 118.17; 117.70; 117.50; 116.90