Euro retests key supports ahead of US jobs data

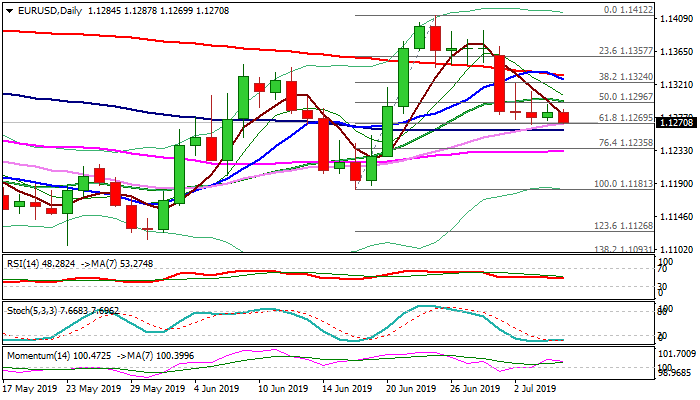

The dollar firmed in early European trading on Friday after holding within narrow range in Asia, sending Euro lower for repeated test of key supports at 1.1280/60 zone (daily cloud top / Fibo 38.2% of 1.1181/1.1412, reinforced by 30DMA and 100DMA), which contained the action in past three days.

Daily MA’s are in mixed setup, bullish momentum eases, stochastic is deeply oversold and RSI neutral, lacking clearer direction signal.

Daily cloud starts steep fall today and will twist next week that may attract bears.

The pair is looking for a catalyst that could be provided from US jobs data, due later today.

Non-Farm Payrolls are forecasted at 160K in June, compared to strong fall to 75K previous month and earnings are also expected to rise (June 0.3% f/c vs 0.2% prev), however, negative dollar’s sentiment on low inflation and expectations for rate cut, is unlikely to be significantly improved by positive US jobs data.

Pivotal levels lay at 1.1260 (100DMA) and 1.1299 (20DMA) with break of either side to generate initial direction signal.

Res: 1.1287; 1.1299; 1.1322; 1.1333

Sup: 1.1260; 1.1232; 1.1200; 1.1181