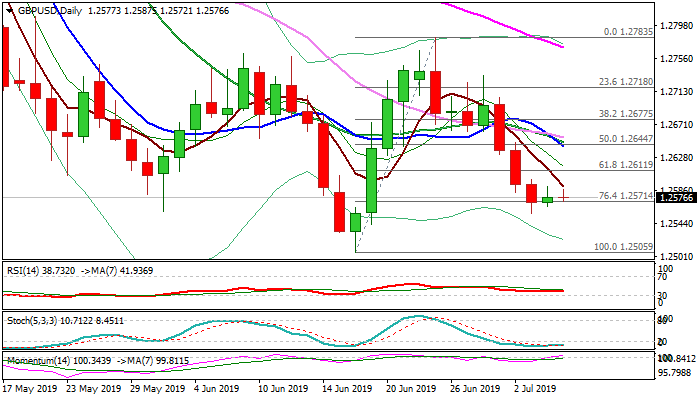

Fall through 1.2500 or rise above 1.2650 possible scenarios after US NFP data

Bears remain on hold, as Thursday’s Doji after three-day fall and early Friday’s action in narrow range, signal indecision, with mixed daily studies supporting scenario.

The pair is looking for fresh signal from US NFP data, which could inflate sterling towards 1.2650/1.2700 zone if today’s release falls well below expectations that would increase risk of Fed rate cut by 0.5% in July’s policy meeting.

On the other side, strong NFP beat would inflate dollar and risk test of cable’s key support at 1.2505 (18 June low).

Res: 1.2590; 1.2644; 1.2654; 1.2677

Sup: 1.2556; 1.2542; 1.2505; 1.2476