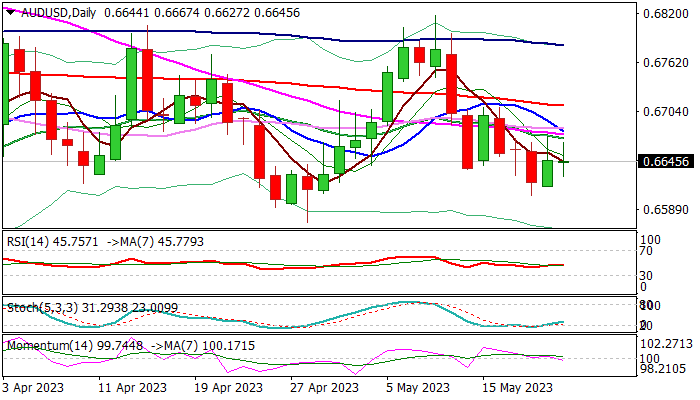

Extended sideways mode looks for fresh direction signals

Australian dollar remains in a choppy and directionless mode for the third straight day, awaiting fresh signals.

Fed Powell’s surprise dovish shift on rate outlook and renewed optimism that debt ceiling talks will resume after staling last Friday, provided some support, but gains were so far short-lived, keeping the price within the range (0.6604/74).

Technical picture on daily chart remains bearish (14-d momentum entered negative territory and MA’s are in bearish setup) keeping near-term focus at key supports at 0.6573/63 (lows of Apr 28 / Mar 10) while the price remains capped by converged falling 20/55/10DMA’s at 0.6680 zone.

Last week’s long-legged Doji candle adds to unclear near-term direction, with firmer bearish signals expected on break of range floor, reinforced by weekly cloud base (initial) and 0.6573/63 pivots, which will signal bearish continuation.

Conversely, lift above range top would generate initial bullish signal which will need confirmation on break of daily cloud base / daily Tenkan-sen (0.6705/11).

Res: 0.6675; 0.6711; 0.6736; 0.6767

Sup: 0.6605; 0.6573; 0.6563; 0.6547